SENTIMENTAL ANALYSIS

Emotion evaluation can be used in order to evaluate exactly how additional investors experience a specific foreign currency set.

Previously, all of us stated which cost motion ought to in theory reveal just about all obtainable marketplace info. Regrettably for all of us foreign exchange investors, this isn’t that easy.

The actual foreign exchange marketplaces don’t merely reveal all the info available simply because investors may just about all simply behave exactly the same method. Obviously, which isn’t exactly how points function.

For this reason emotion evaluation is essential. Every investor offers his / her personal viewpoint associated with the reason why the marketplace is actually behaving the way in which it will as well as regardless of whether in order to industry within the exact same path from the marketplace or even towards this.

The marketplace is like Myspace – it’s the complicated system comprised of people who wish to junk e-mail the information rss feeds.

Joking apart, the marketplace essentially signifies exactly what just about all investors – a person, Warren Buffet, or even Celine in the donut store – experience the marketplace.

Every trader’s view, that are indicated via what ever placement these people consider, assists type the entire emotion from the marketplace it doesn’t matter what info is offered.

The issue is which because list investors, regardless of exactly how highly you are feeling in regards to a particular industry, a person can’t proceed the actual foreign exchange marketplaces to your benefit.

Even though you genuinely think that the actual buck will increase, however everybody else is actually bearish onto it, there’s absolutely nothing a lot that you can do about this (unless you’re among the GSs – George Soros or even Goldman Sachs! ).

Like a investor, you need to consider all of this into account. You have to carry out emotion evaluation.

It’s your decision in order to evaluate the way the marketplace is actually sensation, be it bullish or even bearish.

After that you need to choose exactly how you need to include your own belief associated with marketplace emotion in to your own buying and selling technique.

If you opt to merely disregard marketplace emotion, that’s your decision. However hello, we’re suggesting right now, it’s your own reduction!

Emotion evaluation is usually utilized like a contrarian sign.

A few few suggestions the reason why this really is.

1 concept at the rear of this really is in the event that EVERYBODY (or nearly everyone) gives exactly the same emotion, after that it’s time for you to proceed hipster as well as industry from the well-liked emotion.

For instance, in the event that everybody as well as their own mamas tend to be bullish EUR/USD, after that it may be time for you to proceed brief.

The reason why? Regrettably, you’ll need to proceed additional lower the college to discover! ‘!

An additional concept is actually that many list foreign exchange investors (unfortunately) pull. Based on exactly where you discover data, in between 70-80% associated with list investors generate losses.

If you realize that all of these these types of unprofitable investors who’re generally incorrect are presently lengthy EUR/USD…. nicely, theeeeeen. 🤔

It may be smart to perform the alternative associated with exactly what these people perform!

Having the ability to evaluate marketplace emotion also known as emotion evaluation is definitely an essential device inside your tool kit.

Afterwards within college, we’ll educate you on how you can evaluate marketplace emotion as well as utilize it to your benefit, such as Jedi thoughts methods.

Foreign exchange emotion evaluation could be a helpful device to assist investors realize as well as behave upon cost conduct. Whilst using seem specialized as well as basic looks at is actually crucial, getting one more really feel for that marketplace general opinion may include level to some trader’s look at associated with foreign exchange along with other marketplaces. In the following paragraphs, all of us describe exactly what marketplace emotion is actually, exactly how this pertains to forex currency trading, as well as exactly what the very best emotion indications tend to be.

WHAT’S MARKETPLACE EMOTION?

Marketplace emotion identifies exactly how traders experience a specific marketplace or even monetary device. Because investors, emotion gets much more good because common marketplace general opinion gets much more good. Similarly, in the event that marketplace individuals start to possess a damaging mindset, emotion may become damaging.

As a result, investors make use of emotion evaluation in order to determine an industry because bullish or even bearish, having a keep marketplace seen as a property heading down, along with a fluff marketplace through costs rising. Investors may evaluate marketplace emotion using a selection of resources for example emotion indications (see below), as well as simply by viewing the actual motion from the marketplaces, while using ensuing info to create their own choices.

WHAT’S EMOTION EVALUATION WITHIN FOREX CURRENCY TRADING?

Foreign exchange emotion evaluation may be the procedure for determining the actual placement associated with investors, regardless of whether internet lengthy or even internet brief, in order to impact your personal buying and selling choices within the foreign currency marketplace. Whilst emotion evaluation could be straight converted in order to foreign exchange, it’s also employed for shares along with other property. Contrarian traders will appear with regard to crowds of people in order to possibly purchase or even market a particular foreign currency set, whilst waiting around to consider a situation within the reverse path associated with emotion.

EXACTLY HOW FOREIGN EXCHANGE EMOTION EVALUATION FUNCTIONS

A good example of exactly how emotion evaluation could be used within forex currency trading is really a big solitary motion within GBP/USD within 2016, along with damaging emotion delivering GBP slumping to some 31-year reduced subsequent Britain’s election in order to depart europe. Following extensively good emotion within the 12 months which adopted, damaging emotion after that required more than high of 2018 once again prior to costs began to pattern greater within 2019.

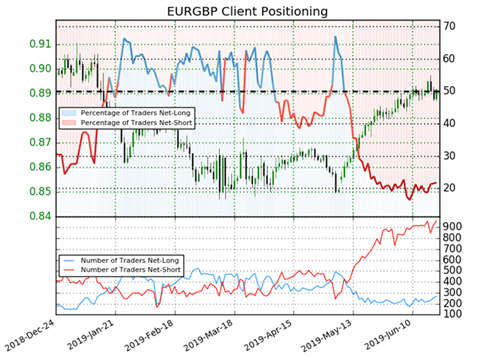

An additional instance associated with internet brief emotion is visible within the EUR/GBP graph beneath, along with twenty one. 9% associated with investors net-long having a percentage associated with investors brief in order to lengthy from 3. fifty eight to at least one. The actual graph exhibits within azure the actual portion associated with IG investors going for a internet lengthy placement, as well as within red-colored the actual portion going for a internet brief placement.

Graph to exhibit internet damaging emotion together with cost motion

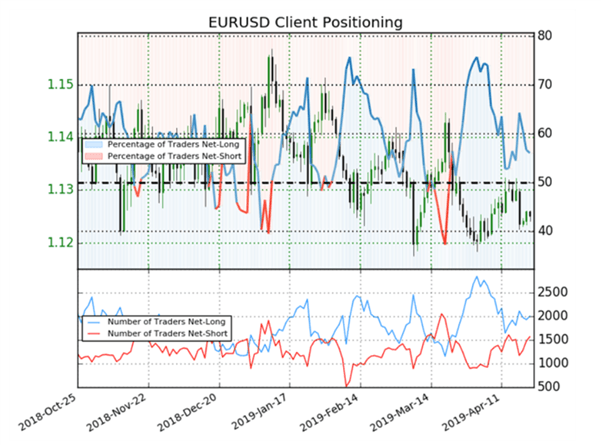

Increasing emotion might imply you will find couple of investors remaining to maintain pressing the actual pattern upward. In this instance, investors might want to watch out for a cost change. However, a cost shifting reduce, displaying indicators it offers capped might quick the emotion investor in order to key in brief. The actual beneath graph exhibits a good example of the actual EUR/USD set going through internet good emotion.

USING SENTIMENT INDICATORS

Sentiment indicators are numeric or graphic representations of how optimistic or pessimistic traders are about market conditions. This can refer to the percentage of trades that have taken a given position in a currency pair. For example, 70% of traders going long and 30% going short will simply mean 70% of traders are long on the currency pair.

The best sentiment indicators for forex traders include IG Client Sentiment (as seen in the charts above) and the Commitment of Traders (COT) Report.