Interest Rate

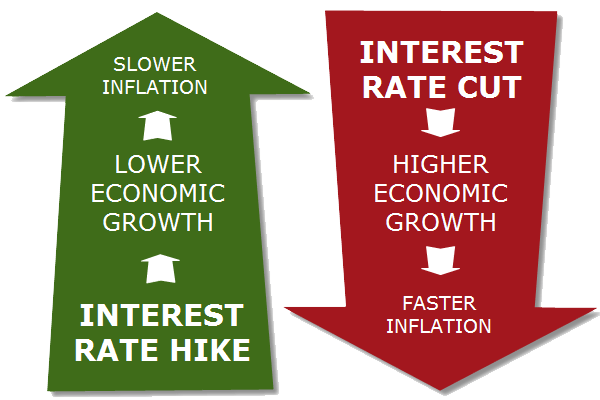

Quite simply, the foreign exchange market is actually dominated through worldwide rates of interest. The currency’s rate of interest has become the greatest element in identifying the actual recognized worth of the foreign currency. Therefore understanding how the nation’s main financial institution models it’s financial plan, for example rate of interest choices, is really a essential point in order to cover your face close to.

Greater rates of interest provide loan companies within an economic climate a greater come back family member abroad. Consequently, greater rates of interest appeal to international funds as well as trigger the actual trade price to increase…. The alternative romantic relationship is available with regard to lowering rates of interest – that’s, reduce rates of interest often reduce trade prices.

Impact associated with reduce rates of interest

Slow up the motivation in order to save. Reduce rates of interest provide a scaled-down come back through preserving….

Less expensive credit expenses. Reduce rates of interest help to make the price of credit less expensive….

Reduce home loan curiosity obligations….

Increasing resource costs….

Devaluation within the trade price.

A glance at the actual financial results of the reduce within rates of interest.

Overview

Reduce rates of interest allow it to be less expensive in order to be lent. This particular has a tendency to motivate investing as well as expense. This particular results in greater combination need (AD) as well as financial development. This particular improve within ADVERT could also trigger inflationary demands.

Theoretically, reduce rates of interest may:

Slow up the motivation in order to save. Reduce rates of interest provide a scaled-down come back through preserving. This particular reduce motivation in order to save may motivate customers to invest instead of keep cash.

Less expensive credit expenses. Reduce rates of interest help to make the price of credit less expensive. It’ll motivate customers as well as companies to get financial loans in order to financial higher investing as well as expense.

Reduce home loan curiosity obligations. The drop within rates of interest may slow up the month-to-month price associated with home loan repayments. This can depart homeowners with increased throw away earnings and really should result in a increase within customer investing.

Increasing resource costs. Reduce rates of interest allow it to be more appealing to purchase property for example real estate. This can result in a increase internally costs and for that reason increase within prosperity. Elevated prosperity will even motivate customer investing because self-confidence is going to be greater. (wealth effect)

Devaluation within the trade price. When the UNITED KINGDOM decrease rates of interest, this causes it to be fairly much less appealing to cut costs in the united kingdom (you might obtain a much better price associated with come back within an additional country). Consequently you will see much less need for that Lb Sterling leading to the drop within it’s worth. The drop within the trade price can make UNITED KINGDOM exports much more aggressive as well as imports more costly. This helps you to improve combination need.

General, reduce rates of interest ought to result in a increase within Combination Need (AD) = D + We + Grams + By – Michael. Reduce rates of interest aid in increasing (C), (I) as well as (X-M).