Housing Data

The united states housing industry accident within 2007 resulted in the actual worldwide economic crisis annually later on. This kind of may be the effect associated with housing industry information about the worldwide economic climate. The actual housing industry information reveal the actual natural power of the country’s economic climate. Therefore, it’s the serious impact about the foreign currency worth from the particular nation through in which the information is actually rising. Using a great knowledge of the actual real estate information might allow the foreign currency investor to consider brief or even lengthy placement in the correct amount of time in the right foreign currency set within the foreign exchange market.

Just how can FOREX investors take advantage of real estate indices?

Exactly why is real estate information essential?

Throughout intervals associated with powerful financial exercise, the actual housing industry plays a role in almost 20% associated with GROSS DOMESTIC PRODUCT. This really is especially accurate regarding the united states. Increased building exercise includes a good impact on the actual GROSS DOMESTIC PRODUCT within 2 methods. Normally, the very first the first is the actual improve within GROSS DOMESTIC PRODUCT due to a increase within the buy associated with houses. House buy generally results in the need with regard to real estate providers as well as eventually a rise within the customer investing. In america, home expense plays a role in 5% associated with GROSS DOMESTIC PRODUCT. The actual home expense hard disks customer investing. This particular adds in between 12% as well as 15% from the GROSS DOMESTIC PRODUCT from the ALL OF US. For instance, within 2015, the actual building exercise led $900 million or even 6% from the GROSS DOMESTIC PRODUCT people. Within 2006, once the housing industry had been from it’s maximum, the actual building exercise led $1. 195 trillion or even 8. 9% from the GROSS DOMESTIC PRODUCT from the ALL OF US. Therefore, the decrease within the housing industry may have an enormous damaging impact on the entire procurement as well as production business. It ought to be mentioned which property building is actually work rigorous. Therefore, the fall within the housing industry may ultimately result in the rise within the joblessness price.

If you find the decrease within the property exercise, the worthiness associated with home qualities begins slipping. A home proprietor might or even might not come with an purpose to market their house. Nevertheless, he’ll have the actual substantial reduction in the actual home loan provided by banking institutions. Eventually, this particular results in the reduction in the customer investing. It ought to be mentioned which customer investing makes up about almost 70% associated with GROSS DOMESTIC PRODUCT in the united states.

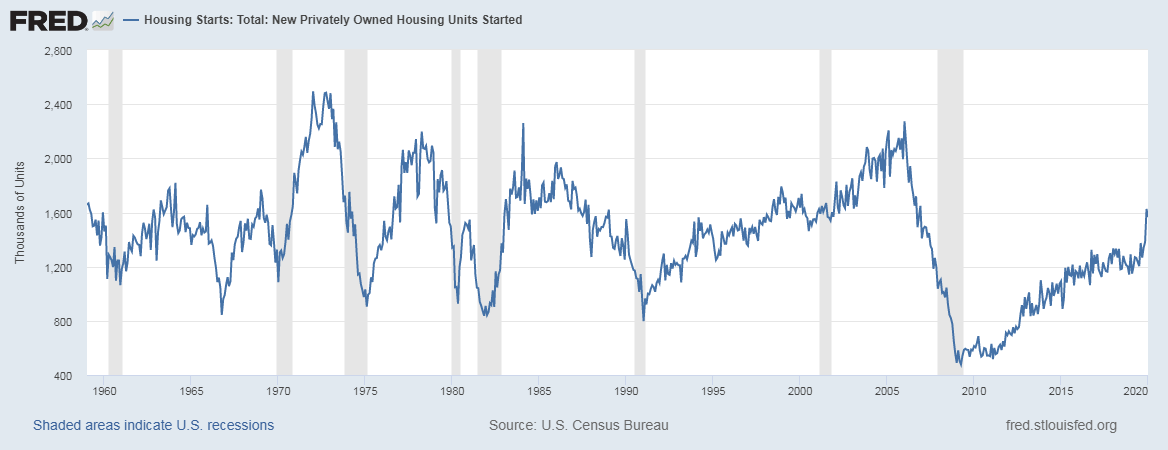

The reduction in the customer investing additional boosts the joblessness price, reduces earnings as well as decreases investing. This particular cyclical impact might lastly result in economic downturn. That’s the reason marketplace carefully screens the actual real estate information, for example real estate begins, the industry top sign from the economic climate.

Impact associated with real estate information about the foreign currency price

Once the real estate field information is actually good, the main financial institution from the particular nation might make an effort to preserve the managed development. To do this, the actual main financial institution might boost the rates of interest in order to get rid of away unneeded liquidity in the program. An increase within the rates of interest might appeal to traders, therefore resulting in an increase within the worth from the country’s foreign currency. The actual quantum associated with increase within the effectiveness of the actual foreign currency depends upon the kind of the actual real estate catalog information as well as the quantity of confidence this bears.

Once the housing industry begins decreasing, in order to encourage development, the main financial institution may make an effort to boost the liquidity on the market. Mortgage loan reduce might prevent traders, therefore producing a decrease within the worth from the foreign currency from the particular nation.

Different types of real estate information

You will find different types of real estate information documented through numerous establishments. The majority of the real estate information tend to be documented from month to month.

Brand new house product sales — The actual unadjusted information, released from month to month through the ALL OF US Census Agency, reveal the actual purchase associated with brand new homes becoming built. The business additionally posts seasonally modified yearly product sales information. The information is actually indicated like a portion on the month-over-month foundation. The actual effect from the information about the foreign currency marketplace is actually reasonable.

Impending house product sales — It’s a fairly brand new catalog developed by the actual Nationwide Organization associated with Real estate agents. The information is actually gathered through realtors as well as agents. The actual impending or even long term house product sales get to be the real house product sales inside a period associated with 8 weeks. Therefore, it’s regarded as a precise sign from the real estate field. The bottom worth from the catalog is actually 100, as the bottom 12 months is actually 2001. Each month-to-month as well as annual information tend to be documented. It’s the reasonable impact on the actual foreign currency markets.

Current house product sales — It’s also documented through the Nationwide Organization associated with Real estate agents. The information reveal the actual existing problems in america housing industry. Close to the 25th of each and every 30 days, the present house product sales information addressing 4 main areas in america tend to be documented. The information, which supplies the system product sales as well as worth associated with current houses, handles condominiums, solitary loved ones homes, as well as co-ops. Once again, this particular information includes a reasonable effect on the actual foreign currency marketplace.

Real estate begins as well as creating enables — The actual Census Agency from the ALL OF US Division associated with Business posts the actual real estate begins as well as creating enables information upon close to sixteenth of each and every 30 days. This provides a concept associated with the amount of and building plots in which the real estate building offers started. The information includes a reasonable impact on the foreign exchange market.

NAHB Housing industry Catalog (HMI) — The actual catalog reading through is dependant on the actual month-to-month study from the Nationwide Organization associated with House Contractors (NAHB). The actual study is actually targeted in order to measure the single-family housing industry situation. The actual HMI reading through may vary from 0 in order to 100 and it has the reasonable effect on the actual foreign currency marketplace.

S&P/Case-Shiller House Cost Indices — The actual catalog exhibits the actual alter within the worth from the home property within 20 areas over the ALL OF US. The information is actually documented through Regular & Poor’s. It’s a minimal effect on the foreign exchange market.

Home loan Programs (Percentage) — The information reveal the actual home loan exercise within the earlier 7 days. The information, documented through Home loan Lenders Organization (MBA), includes a reduced effect on the actual foreign currency marketplace.

Home loan Price (Percentage) — The information show the actual home loan price developments within the real estate field. Therefore, this tosses the gentle about the existing housing industry problems. The actual every week information is actually documented through Freddie Macintosh and it has a minimal effect on the actual foreign currency marketplace.

Halifax home cost catalog — It’s a information launched at the conclusion of each and every 30 days through Lloyd’s Financial institution Team. The information display the actual quantum associated with alter within the property as well as real estate costs in the uk. The information offers reduced effect on the foreign exchange market. This primarily impacts the actual Uk lb.

The investor must have a great understanding of the actual different types of real estate indices and it is effect on the actual foreign currency marketplace. Just after that large wagers could be created completely right after the information, regarding the actual housing industry, is actually launched.