BOLLINGER BAND

Bollinger Brand, the specialized sign produced by Steve Bollinger, are utilized in order to calculate the market’s volatility. as well as determine “overbought” or even “oversold” problems.

Essentially, this particular small device informs all of us if the marketplace is actually peaceful or even if the marketplace is actually NOISY!

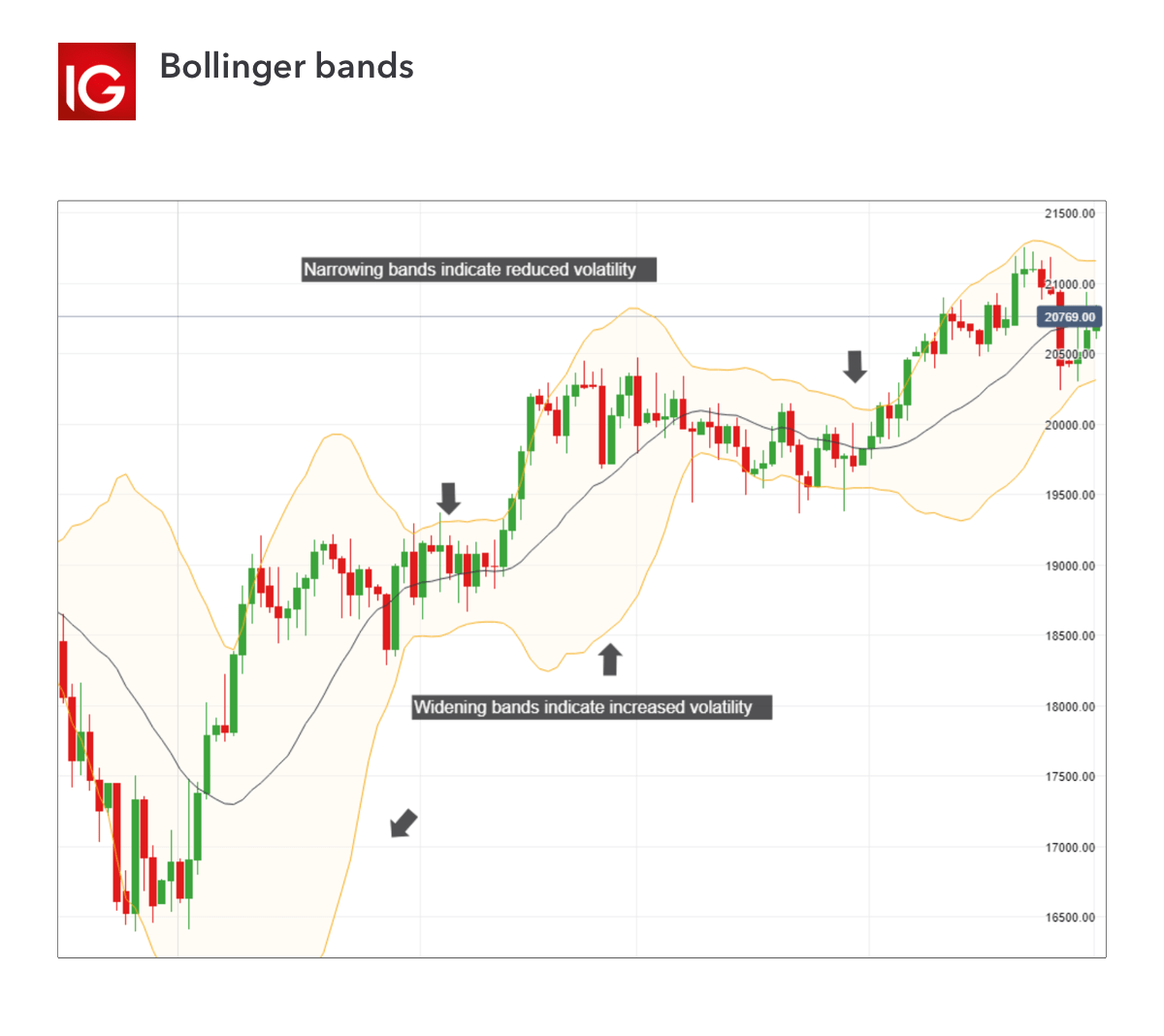

Once the marketplace is actually peaceful, the actual rings agreement so when the marketplace is actually NOISY, the actual rings increase.

Consider the graph beneath. The actual Bollinger Rings (BB) is really a graph overlay sign which means it’s shown within the cost.

Discover exactly how once the cost is actually peaceful, the actual rings tend to be near collectively. Once the cost techniques upward, the actual rings distribute aside.

Top of the as well as reduce rings calculate volatility, or even their education within the variance associated with costs with time.

Simply because Bollinger Rings calculate volatility, the actual rings change instantly in order to altering marketplace problems.

That’s just about all there’s into it. Indeed, we’re able to just lose interest a person through starting a brief history from the Bollinger Rings, exactly how it’s determined, the actual numerical formulations at the rear of this, and so forth and so on, however all of us truly didn’t seem like inputting everything away.

Alright good good, we’ll provide a short description…

What exactly are Bollinger Rings?

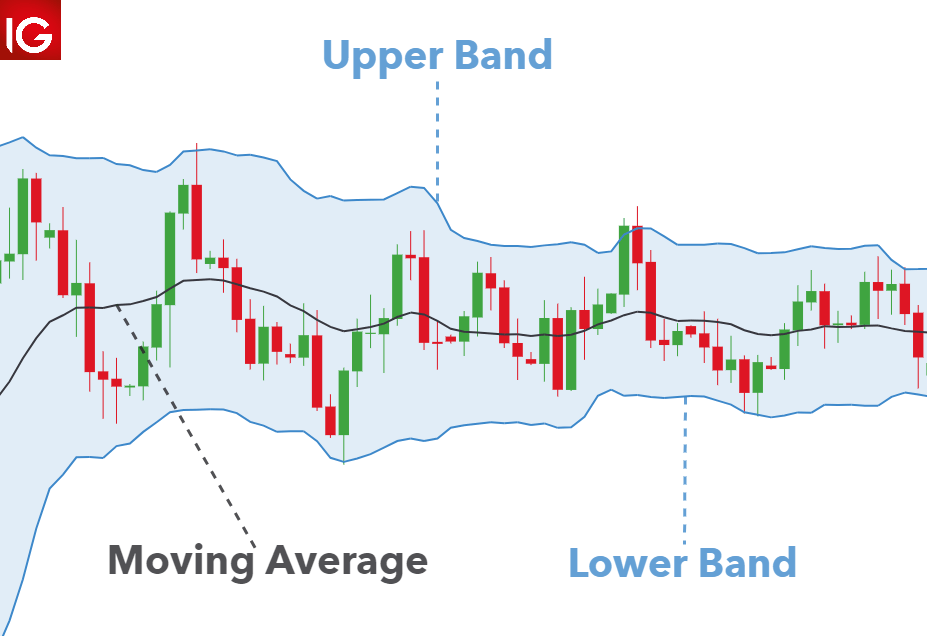

Bollinger Rings are usually plotted because 3 outlines:

A good top music group

The center collection

Less music group

The center type of the actual sign is really a easy shifting typical (SMA).

The majority of charting applications default to some 20-period, that is good for many investors, however, you may test out various shifting typical measures once you obtain a small encounter using Bollinger Rings.

Top of the as well as reduce rings, automatically, signify 2 regular deviations over as well as beneath the center collection (moving average).

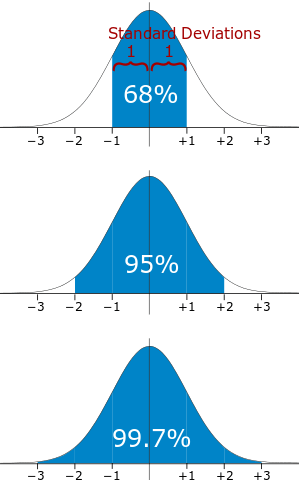

In the event that you’re freaking away simply because you’re unfamiliar with regular deviations.

Don’t have any concern.

The idea operating system regular change (SD) is simply the way of measuring exactly how disseminate amounts tend to be.

When the top as well as reduce rings tend to be 1 regular change, which means that regarding 68% associated with cost techniques possess happened lately tend to be INCLUDED inside these types of rings.

When the top as well as reduce rings tend to be two regular deviations, which means that regarding 95% associated with cost techniques possess happened lately tend to be INCLUDED inside these types of rings.

You’re most likely dropping off to sleep let’s strike a person by having an picture.

As possible observe, the larger the worthiness associated with SD you utilize for that rings, the greater costs the actual rings “capture”.

You can test away various regular deviations for that rings when you be acquainted with that they function.

To tell the truth, to get going, a person don’t have to know the majority of these things. All of us believe it’s much more essential that people demonstrate a few methods for you to utilize the actual Bollinger Rings for your buying and selling.

Be aware: Should you actually want to find out about the actual information of the Bollinger Rings, take a look at John’s guide, Bollinger upon Bollinger Rings, or even take a look at the beautiful Forexpedia web page upon Bollinger Rings.

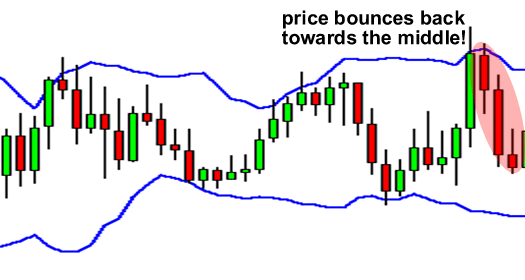

The actual Bollinger Rebound

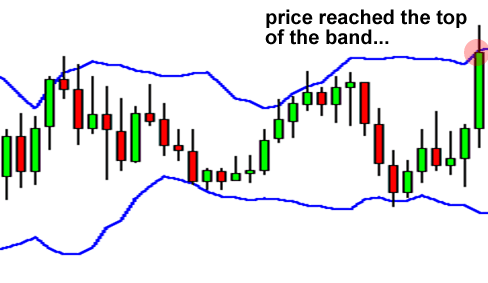

Something you need to know regarding Bollinger Rings is actually which cost has a tendency to go back to the center of the actual rings.

That’s the entire concept at the rear of the actual “Bollinger Rebound. ”

Through taking a look at the actual graph beneath, are you able to inform us in which the cost may proceed following?

If you said down, then you are correct! As you can see, the price settled back down towards the middle area of the bands.

That which you simply noticed had been a vintage Bollinger Rebound. The main reason these types of bounces happen happens because the actual Bollinger rings become powerful assistance as well as opposition amounts.

The actual lengthier time body you’re within, the actual more powerful these types of rings are usually.

Numerous investors allow us techniques which flourish upon these types of bounces which technique is better utilized once the marketplace is actually varying as well as there isn’t any obvious pattern.

You simply wish to industry this method whenever costs trendless. Therefore keep in mind the actual THICKNESS from the rings.

Prevent buying and selling the actual Bollinger Rebound once the rings tend to be growing, simply because this particular results in the cost isn’t shifting inside a variety however in the PATTERN!

Rather, search for these types of problems once the rings tend to be steady as well as getting.

Right now let’s take a look at a method to make use of Bollinger Rings once the marketplace is actually TRENDING…

Bollinger Press

The actual “Bollinger Squeeze” is actually fairly self-explanatory. Once the rings press collectively, this results in that the large is actually on the point of occur.

When the candle lights begin to bust out over the very best music group, then your proceed will often carry on to increase.

When the candle lights begin to bust out beneath the underside music group, after that cost will often still drop.

Taking a look at the actual graph over, you can observe the actual rings squeezing collectively. The cost offers simply began to split from the best music group. Depending on these details, exactly where do you consider the cost goes?

This is the way an average Bollinger Press functions.

This tactic is made for you to definitely capture the proceed as soon as feasible.

Setups such as these types of don’t happen every single day, however, you often will place all of them several times per week in the event that you are considering the 15-minute graph.

There are lots of additional steps you can take along with Bollinger Rings, however they are both most typical methods related to all of them.

Go on and include the actual sign for your graphs watching exactly how costs proceed with regards to the 3 rings. As soon as you’ve obtained the actual suspend from it, attempt altering upward a few of the indicator’s guidelines.

It’s time for you to place this particular inside your trader’s tool kit prior to all of us proceed to the following sign.